A Simplified Explanation: Why We Have Inflation

No Bernie and Elizabeth Warren, it's not "corporate greed."

Monetary policy is confusing and, if we’re being honest, a little scary. My guess is that if everyone in the country could instantly magically understand how our monetary system works, most of the stores would be looted by the end of the night, and within a week, people would be tearing copper pipes out of the buildings to trade for chickens.

That being said, it’s a lot easier to explain inflation than monetary policy, although this sort of politically motivated nonsense makes it much more difficult:

So, let’s unpack all of this. We’ll start with an explanation of why inflation occurs that everyone can understand and then get back to the politicians.

First of all, what causes inflation? It’s caused by too much money chasing too few goods (incidentally, that idea comes straight from the late, great economist, Milton Friedman).

What do I mean by that?

Well, since this is supposed to be simplified, let’s break it all the way down and start with supply and demand.

If the supply of something is large and the demand is comparatively small, it’s cheap. For example, how much are you willing to pay me for a jar of plain old, nothing special about it, dirt just like you have in your front yard? For most people, the answer would be “nothing” because they already have an abundant, easily obtainable supply of it available. Maybe there MIGHT be some tiny number of people who are willing to pay some small sum for that dirt because they have a hole they want to fill in, but we can all agree that the value of my jar of dirt is going to be extraordinarily low.

On the other hand, what if the supply of something is limited and the demand for it vastly exceeds the supply? Then, it's going to be quite expensive. For example, the most expensive mansion in America lists for 295 million dollars. Why would someone want to pay that much for a place to live? Because it’s an exquisitely designed, 105,000 square feet mansion on top of a mountain in Bel Air. It has 21 bedrooms, 42 bathrooms, a bowling alley, a home theater that sits 40, an outdoor running track, an amazing view of downtown Los Angeles, and even has a MOAT. The number of people who would like to own that mansion is enormous, but the supply is “1,” which means that the cost is going to be very high indeed.

So, what we’re talking about with inflation is an across-the-board increase in demand. This is different than say, the price gouging cases you hear about after hurricanes sometimes where some independent gas station owner charges everyone $9 a gallon for gas. What’s happening there? Well, the normal supply chain has broken down so that while there may be a high demand for gas, the supply is very limited. In those circumstances, people can charge exorbitant fees and get them. This is also why the supply chain crisis is driving up the cost of certain goods. If the demand for something stays the same, but the supply drops, it will drive up prices. Of course, that’s only going to apply to a certain number of limited goods. Most things in our economy are not stuck waiting to be offloaded by a badly run port in California or are unable to get past a bunch of Canadian truckers.

Again, with a nod to Mr. Friedman, inflation is a monetary phenomenon.

So, how does that work?

Well, let’s say tomorrow, you were given a million dollars, tax-free, and told to spend it all locally in a week. What would you do with it? Well, you might upgrade the house you live in. No 105,000 square foot mega-mansion, but something nicer with an extra bedroom and a driveway, right? If your car is a little old, you might get a new one. Maybe you replace your living room couch, upgrade your wardrobe, buy the kid that ridiculously expensive mountain bike he wanted that you couldn’t believe cost that much, get a new 70-inch, high-def TV for the living room, etc., etc., etc. Let’s just say none of us would have any trouble spending all that free money, right?

Now, let’s change our scenario just a little bit. Let’s imagine that EVERYONE, where you live, was given a million dollars and told to spend it all locally in a week. You’d go to the dealership to buy a new car and there wouldn’t be any available. The houses that cost 200k last week would be selling for a million today. There would be shortages everywhere and prices would have gone up more than you thought was possible.

So, how is this relevant to the crisis we currently face?

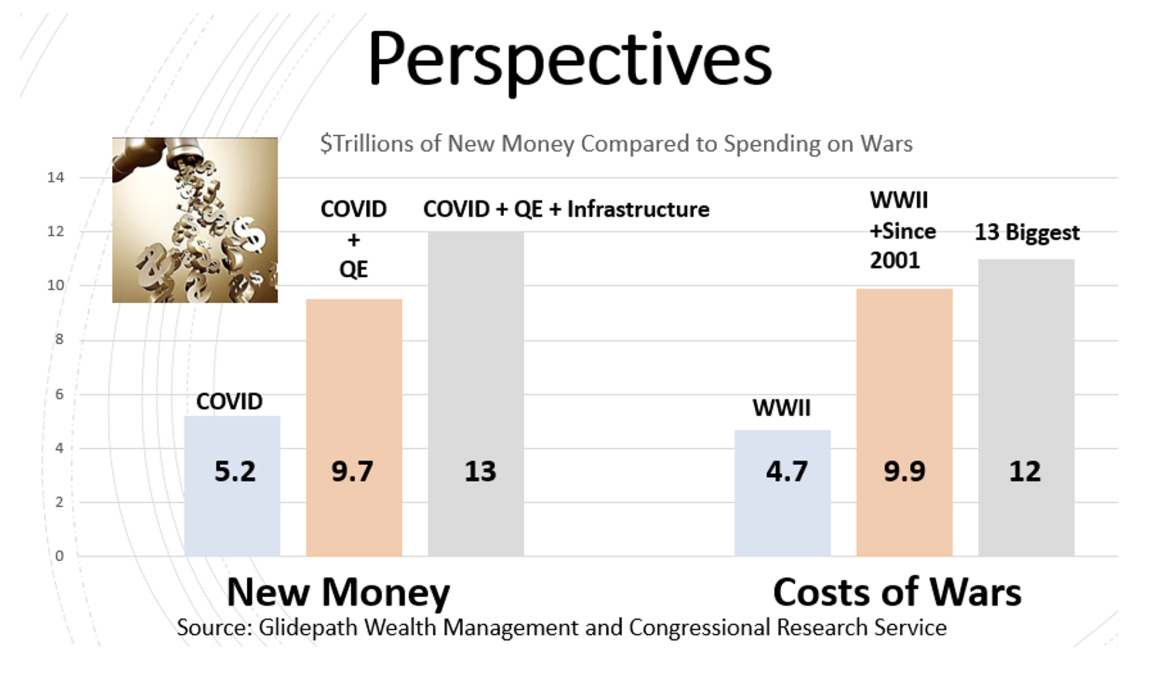

Well, first of all, COVID, along with the extraordinarily foolish lockdowns that went with it, was economically painful and the pain-reliever of choice was borrowing, printing, and dumping money into the economy over a short time period on a level never previously seen before by humankind.

So, there’s money flooding into the economy from every direction. The government is LITERALLY sending people money to spend in the mail and… then what?

Well, to dramatically oversimplify, think about it like this. Imagine you live in a small town that’s in an honest-to-goodness bubble! No goods, no services, and nobody is coming in or out. Bubble town has $100,000 worth of goods and services being bought each year and $100,000 used to buy those goods and services. What happens when the mayor of Bubble town decides to double the money supply to $200,000? Does everyone get twice as prosperous or (hint: this is the right answer) over time, does the price of everything double?

It doubles because the paper money itself has no inherent value. It’s just a way to make it easier for us to trade with each other. Instead of you giving me $1,000 worth of steak in exchange for a $1,000 worth of 9mm ammo that both of us will then have to barter for other things we want, we just say, “This represents a $1,000 worth of goods and services.” Then, trading goods and services becomes easy-peasy, lemon squeezy. If we double the amount of money that represents $1,000 worth of goods and services, then over the long haul, the value of money is going to have to drop by 50% to make it work.

That’s inflation.

Currently, the Federal Reserve is planning to get the rampant inflation we’re experiencing in America under control by raising the cost of borrowing money, which will slow the economy. That will slow the demands for goods and services enough to hopefully get inflation under control. There’s also a pretty decent chance it will tank the stock market, but as always, time will tell.

All this is worth mentioning because, given the size of our debt and the reliance of our economy on cheap money to function, the big problem we currently have with inflation today is going to keep cropping up and getting worse for decades to come. It’s also likely to get considerably worse over time. In fact, some of the worst economic collapses end up looking a lot like this:

Why? Because politicians like Bernie Sanders and Elizabeth Warren cannot afford to tell people the truth. What are they going to do? Say something like this?

“You want to know who’s responsible for the inflation that’s driving you into the poorhouse? If we’re being honest, politicians like us have a lot to do with it. That’s why we’re no longer going to support any new spending programs. In fact, we need to cut government spending. Big time! Sorry folks, but the country is broke and we can’t afford to keep borrowing money just to give it away. Instead, we’ve got to be responsible!”

Know what that is? That’s REALITY and referencing reality is not how you get elected to office in the United States of America today. Instead, especially if you are a Democrat, you get elected by pledging to spend massive amounts of money we don’t have on goodies for your constituents. So, that means you blame those mean old corporations for inflation (as if their competitors wouldn’t happily undercut their prices to take their market share if it was possible), count on people being too dumb to understand what’s happening and try to get those “free” goodies. You tell people they don’t have to pay rent. You put price controls in place as if they worked. I mean, doesn’t it strike anyone as odd that the two most expensive places to rent a place to live in America are San Francisco and Manhattan, both of which have rent control? Why is that? Because, as the founder of modern economics, Adam Smith, so famously said:

When the government makes it unprofitable to produce goods, people stop producing those goods.

It’s important to understand all of this because if people understand where we came from, where it leads, and where the people like Elizabeth Warren and Bernie Sanders will eventually take us if we let them, maybe they can play a part in stopping our long slide into economic oblivion before it’s too late.

I've said it since I heard about the first stimulus checks being given out, We're going to see inflation hit big time if this keeps up. Guess what, it didn't take long for it to hit! Why do people keep believing the politicians? What makes the average "Joe" so F'n ignorant? And the worst part is they keep believing them and voting them in office! Once in office they keep spending. Our Founding Fathers were pretty smart but I wished they had put clauses in for term limits and balanced budgets!

Of course this is correct, but it requires the ability to think logically to understand it. How much easier to engage in magical thinking? The people who raised me are fervent Bernie and Liz disciples, eager to spread the news that greedy corporations are destroying the middle class. The only information they receive comes from MSNBC, and those facts "prove" that it's the wealthy who are hoarding all the money. You can't cut through the cocoon that surrounds them, no matter what you say. If you try, you'll be told it's proof that you're a fascist, not to mention a racist because of "unequal outcomes" you know. There is a section of our nation that is allergic to truth; they simply go into hysterics at its mention. Only hitting rock bottom will introduce reality, but of course the chaos will be horrific. Leftist thought is the real enemy, as always.