Elon Musk vs. The Takers

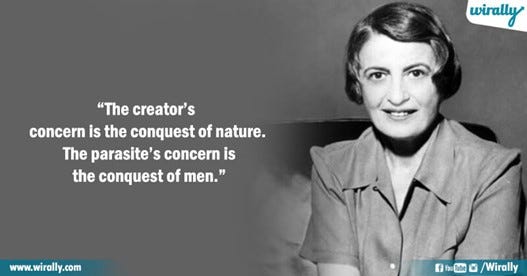

Makers vs. Takers

Elon Musk is not only the richest man in the world at the moment, with a net worth of 281 billion, he’s the living embodiment of Randian capitalism. As such, he’s the perfect target for the “loot-em-all and let the IRS sort it out” crowd, and some of his recent sparring sessions with them are very instructive. They can teach you a lot about what’s wrong with our culture’s approach to government along with the dishonesty of our media. For example, have you ever wondered how you can simultaneously see headlines like this…

Elon Musk, world’s second-richest person, paid $0 in federal income tax in 2018, report claims

Elon Musk: Visionary, Innovator, Freeloader | Inc.com

ProPublica: Many of the uber-rich pay next to no income tax

…while simultaneously seeing charts like this?

How can it be that people like Elon Musk are simultaneously paying no taxes while the wealthiest 25% of Americans are also paying 87% of income taxes? Unsurprisingly, the answer is that the mainstream media has been lying to you. I can tell you this definitively because when I heard that Elon Musk had supposedly found a loophole that allowed him not to pay taxes, the first thing I did was reach out to my accountant and ask him if there was a way for someone like me to copy what he was doing. His answer was, “no” and he explained that Elon Musk wasn’t actually avoiding taxes. After talking to him and doing some more research, I finally understood what was going on.

First of all, Musk doesn’t get a salary from Tesla. His massive net worth comes from owning stock. That is beneficial from a tax standpoint because the capital gains rate (more on that in a moment) is lower than the rate for regular income. However, that’s well known. Here’s what the really rich guys like Musk are doing that’s different. They go to a bank and borrow a large sum of money for their living expenses. They get the money at an extremely low-interest rate because there is virtually no risk in loaning money to people as wealthy as Elon Musk. Then, they live off of the borrowed money. That means they may be able to go without paying very much or in some cases, anything at all, in federal taxes for years. This is where the mainstream media, which is trying to mislead you, stops the story. However, there’s more. What someone like Musk is waiting to do is sell his stock at an opportune time, when prices are high, to pay back the loan. This maximizes his profits and also, ironically, maximizes the amount that he pays to the government in capital gains. So, whether someone like Musk pays his capital gains tax each year or pays an even larger amount in one lump sum every few years, he is still paying an extraordinary amount of taxes.

That brings us to the second instructive clash between Elon Musk and Democratic Senator Ron Wyden:

Ron Wyden has been championing the idea of taxing UNREALIZED capital gains. This gives you a very basic explanation of this bizarre proposal, although there are all sorts of other convoluted rules designed to try to make this lead turd of a proposal float:

Wyden's draft legislation would apply a new tax, beginning in 2022, for individuals with at least $1 billion in assets or $100 million annual income in three straight taxable years. It would apply to about 700 people, according to Wyden’s office.

It would create a “mark-to-market” system for taxing the gain or loss in value of stock, dividends, and other tradable assets each year, according to a summary from Wyden's office. At the end of the tax year, these assets would be subject to tax based on the change in their market value from the previous year. Any gain would then, in most cases, be subject to long-term capital gains tax of up to 23.8 percent tax rate under current law.

If we were discussing the many reasons why this is a bad idea, it’s worth starting with the Capital Gains tax itself. If, one year ago, you and I both had $5,000 left after taxes and I choose to spend mine on a night at a strip club and an expensive after-party with Bunny, Kimber, and Belle while you wisely chose to put your money into a fast-rising cryptocurrency like Ethereum, today you’d have roughly $46,000 if you sold your entire investment (yes, it really went up that much in a year). Keep in mind that you had already paid taxes on that money and, as is the case with all investments, there was an element of risk to your decision. Ethereum could have gone down or out of business entirely. But instead, you made $41,000 and the government will want you to pay taxes again on the profits you made.

What Wyden wants to do is change the rules of the game and say that you owe the money even if you DON’T SELL. For example, let’s say a company is worth 200 million today on paper and next year, it’s valued at 300 million on paper. Wyden wants to treat that as a taxable event. It’s a tax designed to punish long-term investing and wealth creation that would lead to armies of accountants debating what people are theoretically worth, instead of just seeing how much they make or lose when they actually sell things. It’s MADNESS.

Perhaps worst of all for those of us that aren’t as wealthy as Elon Musk, this whole proposal would INEVITABLY filter down to the rest of us in time.

Consider what happened with the income tax. The country experimented with it here and there and then in 1913, it became the law of the land permanently. At the time, it was small and only impacted a tiny fraction of Americans:

Individual federal income tax rates started at 1% in 1913, and the maximum marginal income tax rate was only 7% on incomes above $500,000 (more than $12.8 million in today's dollars). The personal exemption in 1913 was $3,000 for individuals ($77,000 in today's dollars) and $4,000 for married couples (nearly $103,000 in today's dollars), meaning that very few Americans had to pay federal income tax since the average annual income in 1913 was only about $750.

You can cheer the Leftists that want to put this in practice today, but you won’t be cheering when the government eventually decides people like you should owe them more money because of what you could conceivably sell your house for if you weren’t living there. Once something like this is in place, it’s only a matter of time until it filters down to the middle class.

This perfectly ties into the final recent flare-up with Elon Musk, which highlights the most important issue that few people take seriously in our society. This began with a fairly typical pie-in-the-sky claim from the director of the UN food scarcity organization:

A small group of ultra-wealthy individuals could help solve world hunger with just a fraction of their net worth, says the director of the United Nations' World Food Programme.

Billionaires need to "step up now, on a one-time basis," said David Beasley in an interview on CNN's Connect the World with Becky Anderson that aired Tuesday -- citing specifically the world's two richest men, Jeff Bezos and Elon Musk.

"$6 billion to help 42 million people that are literally going to die if we don't reach them. It's not complicated," he added.

Elon Musk had a beautiful response to this:

Beasley did respond to Musk, but this first tweet gives you an idea of how unsatisfying it was:

The truth is that there isn’t a single major problem on planet Earth that’s going to be fixed at this point by taxing people more. It doesn’t matter what tax rate billionaires pay, we’re not going to get rid of poverty, homelessness, war, change the climate, etc., etc., because if money alone were the fix for these problems, they would have long since been fixed. For example, here’s the summary of a famous 2014 Heritage Foundation report on poverty:

In his January 1964 State of the Union address, President Lyndon Johnson proclaimed, “This administration today, here and now, declares unconditional war on poverty in America.” In the 50 years since that time, U.S. taxpayers have spent over $22 trillion on anti-poverty programs. Adjusted for inflation, this spending (which does not include Social Security or Medicare) is three times the cost of all U.S. military wars since the American Revolution. Yet progress against poverty, as measured by the U.S. Census Bureau, has been minimal, and in terms of President Johnson’s main goal of reducing the “causes” rather than the mere “consequences” of poverty, the War on Poverty has failed completely. In fact, a significant portion of the population is now less capable of self-sufficiency than it was when the War on Poverty began.

Now consider that this isn’t all the money that’s being spent on the problem. For example, in 2020 alone, Americans gave 471 billion dollars to charity. So, why haven’t we solved all these problems? Because governments are slow, stupid, and wasteful. In the most corrupt nations, almost all donated money ends up being stolen. In nations that are marginally corrupt, like the United States, the majority of money is wasted on bureaucracies, politically popular, but ineffective programs, and pay-offs to ineffective, but well-connected contractors. Our government does sometimes “fix” problems, but when it happens, it almost always spends far more than it would have cost in the private sector and creates new problems in the process. This is why our government keeps costing more and more despite the fact that its performance keeps getting worse. For example, look at these per capita spending numbers. The government is spending nearly 3 times as much per person since 1970.

Do you feel like you’re getting 3 times as much value or is our government spending far more and delivering even less? Why in the world do we need to raise taxes on ANYONE at this point? Why isn’t our government doing what every surviving private sector company does in a situation like this, which is cut expenses, prioritize spending, and stop throwing good money after bad? At this point, we could literally just be building giant furnaces and tossing billions of dollars into them every day and it would have the exact same impact as much of the spending our government does on the lives of most Americans. America does have real problems it needs to solve, but there’s very little evidence that they’re going to be solved by giving more of anyone’s money to the government.