How to Not Live Paycheck-to-Paycheck

The 5 principles of getting your finances together.

A lot of Americans have literally never had someone who knows what they’re talking about give them even a basic explanation of how finances work. That’s not to say that the information isn’t readily available, but schools don’t teach it and not everyone knows where to get it. So, they ask mom and dad or their friends, which is perfectly fine if they have themselves together financially, but a lot of them just don’t.

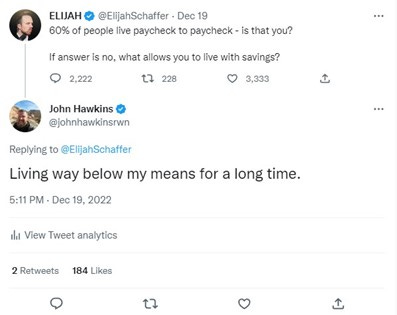

Well today, if you take 10 minutes and read this article, you will at least know how to avoid living paycheck-to-paycheck. This is not a small thing because more than sixty percent of Americans do live paycheck-to-paycheck and if you learn something in 10 minutes that helps you beat more than sixty percent of the population, that’s pretty good.

First of all, just to be clear, I AM NOT one of the people that live paycheck-to-paycheck today, but I used to be. I struggled for a long time before I cracked the code, started saving up money, and eventually started my own business. When I say “struggled,” I mean at times I had to borrow money to repair my car, had $10 budgeted for a week of food, didn’t know where the rent was going to come from, was walking around in clothes with holes in them and once slept in an elevator on a business trip.

So, when I say that I can tell you how to improve your finances to the point where you’ll no longer be living paycheck-to-paycheck, I am not just talking. I am speaking from experience. That experience includes being someone who now lives at the beach and went on vacations to Las Vegas, Anchorage, and New York City last year. So, I know what I’m talking about and if you like this piece, I hope you’ll share it with some friends that are struggling and maybe your college-age kids. It will REALLY help them a lot if they read the advice in this column and implement it in their lives.

To begin with, there is a short version of this. If you assimilate only this one concept, you will reach a point where you never have to live paycheck to paycheck again:

There’s the short version. Now, let’s go into a little more detail about how you can build enough of an economic cushion that you’re not a missed paycheck away from not being able to pay your rent.

First of all, there are only three ways to stockpile money:

1) Make more money.

2) Save more money.

3) Find ways to make money that continue even when you’re not working (i.e., investments and certain types of businesses).

If you want to get wealthy, #3 is where it’s at for most people, but that’s not what this article is about and realistically, most people struggling to pay their bills aren’t really in a good position to create that kind of business or invest…yet.

So, let’s start with #1. How do you “make more money?” You can ask for a raise. You can get a better job. You can get a 2nd job or side hustle. You can sell stuff. Sometimes, people will just GIVE YOU money. Maybe we’re talking about a tax rebate, a relative dying and leaving you money, a big Christmas check, or a government rebate check like we got during COVID.

When you’ve been struggling with finances for a long time and have had your eye on something out of financial reach, the easiest thing in the world to do with “extra” money is spend it on “extra” stuff. This a mistake. Why? Well, that brings us to principle #1…

Principle #1: Peace of mind is worth more than any “stuff” you can buy.

One of the most significant moments in my life was saving up $2,500 for the first time. Know why? Because it meant I could still pay my rent if I lost my job or get my junky car repaired if it broke down. When you’re living paycheck-to-paycheck, you can try to put the stress, anxiety, and worry that causes it into the back of your mind, but it’s always there. It takes away from the quality of your life and guess what? No purse, couch, bike, or flat-screen TV is worth that. If you can buy peace of mind by saving up money, that is an investment worth making.

Furthermore, it’s not as hard to get there as people think. For example, the minimum wage in much of the United States is $7.25. That would mean if you worked 20 hours per week in a part-time job for a little over 17 weeks, you could make an extra $2,500. However, chances are you can beat that number handily in this economy. I have a friend in Myrtle Beach (which is not exactly a high-wage city) who just quit a job at Walmart that paid $16 per hour. It would only take a little less than 8 weeks to save up that amount of money at that pace. We’re not talking about a lifetime commitment to working two jobs here, we’re talking about a few months to help you set enough money back to give you a little security. Is that sacrifice? Sure, but it’s a sacrifice worth making even if you’re earning 4k or 5k instead of $2,500.

Now, how do you “save more money?”

Principle #2: Most people that are broke have too much house and/or too much car.

Why pay so much attention to those two expenditures that they get their own principle? Because that really is where most people screw up their finances. You get this one right? It makes everything else in this area ten times easier. You get it wrong? It’s hard to cut enough in other areas to make up for your mistake. Show me someone who’s making a lot of money and is still broke (and trust me, there are an awful lot of people like that) and you almost always find out they’re blowing it right here.

What’s blowing it? It’s buying a house you can’t afford, paying too much in rent (Hint: The standard 30% is TOO HIGH unless you are already financially secure), living by yourself when you should have roommates, buying a new car when you should get a used one and trading in cars far too soon instead of riding them until the wheels fall off.

This is taking it to an extreme, but when I bought my last car, the salesman apologized to me because he said they could only afford to give me $300 for the one I was trading in because it was so old, beaten up, and broken down. Given everything that was wrong with it, I didn’t feel like he was lowballing me. Do you need to take it that far? No, but don’t try to make yourself feel better or impress your friends with your car unless you are already financially where you want to be. If that’s not you, you should be living as cheaply as you can get by with and thinking about your car as reliable transportation. No more, no less. As to the rest? Well…

Principle #3: If you can’t afford it, you don’t deserve it.

When you’re stressed, working hard, and pushing yourself, it’s very easy to convince yourself that you “deserve” certain things. I can remember having one job that I didn’t particularly like and in the middle of the day, I really enjoyed going down to the lunchroom, buying a Rueben and fries, then unwinding until I had to go back to work. The problem was that cost $200 a month, which comes out to $2,400 per year. When you don’t have a lot of money, that’s way too expensive compared to making your own lunch. At another time in my life, I really got into drinking this particular brand of “healthy” lemonade. It was good stuff. It was also $1+ per bottle and I typically drank 6 per day. $6 per day times 365 is $2,190 a year. On LEMONADE. When you don’t have enough money, you have to look at EVERYTHING through the lens of “can I afford this?”

Principle #4: You NEED a budget.

What are you wasting money on? You should create a budget and find out. I do that and guess what? I have a current budget AND what I think of as a “cheap” budget, which is just the bare-bones expenses that I could cut down to if I want to do so. That bare-bones budget? It’s literally LESS THAN HALF of what my current budget is. I’m financially secure enough today that I don’t have to cut it, but if you’re not, you should be taking a hard look at what you’re spending on everything. Groceries (Could you buy in bulk or generic and cut costs?). Cable TV (Do you need it?). Cell Phone (Maybe you should be using a cheaper phone or a pay-per-minute phone. I do.) Internet (Could you drop a speed tier, save money, and maybe never notice the difference?) Eating out. Nails. Clothes. Etc., etc., etc. Can you find a way to cut the expense or get rid of it entirely? If you really want to dig into this effectively, write down every dime you spend for a month and see where you are REALLY spending your money versus where you think you’re spending it. People tend to really hate this kind of nickel and diming their own spending habits, but what they forget is…

Principle #5: Everything has its season, including building a nest egg.

You can spend your WHOLE life feeling like you’re behind the 8 ball, nervous because you’re a missed paycheck or two from being ruined OR you can spend a few months putting back a nest egg, take that stress off of yourself, and have some options. Options like going back to your old spending habits, which is essentially coasting, but feeling much more secure because you have money in the bank. Continuing to work a second job or saving money to make your nest egg even bigger. Continuing to save money while investing what you’ve already earned. Starting your own business with the money you saved. There are lots of possibilities, all of which are better than going through decades of twisting in the wind to avoid the relatively small period of sacrifice to get a little ahead of the game. Even if it took a year to put some money back, it would be a phenomenal return on your investment for a tiny part of your life.

What it all comes down to is that like a lot of things, putting an end to living paycheck-to-paycheck is simple, but it’s not easy. It certainly wasn’t easy for me and isn’t for most people. However, the pay-off is worth it times ten. There are a lot of things people regret in life but putting in the work it takes to finally achieve a minimum level of security is never one of them.

I was on some forum where someone said that if tomorrow everyone in the world was given $1,000 each -- and he said don't worry about where the money comes from, suppose it's just magic -- that many people would spend the money immediately on something frivolous, alcohol or gambling or fancy jewelry or whatever. Others who are more responsible would buy something of lasting value. But the wisest would invest it and a year from now have $2,000.

This person immediately got a storm of protest from people saying some variation of, Some people are so poor that they'd have no choice but to spend the money on immediate needs. They just can't afford to save and invest.

And I replied, That's why you remain poor. Because you refuse to consider how you might cut your expenses. You just insist that you are spending the bare minimum. You almost surely are not. Yes, there are some people in the world who are so desperately poor that every dime they get has to go to food or they will starve to death. But few people in America or Europe are in that position. Rather, we think that we just HAVE to buy convenient microwave meals instead of cooking from scratch. We just have to have a three-bedroom apartment because you can't expect our two children to sleep in the same room. We just have to have a new car because what would the neighbors think if they saw us driving that old clunker for another year. Or even, I just have to get coffee at Starbucks every morning because I don't have time to make coffee myself at home.

And so you stay poor.

FWIW, here's my tip: Many people think they are being economical because they only buy what they need. The catch to that is, "need" is a very vague concept. It's easy to tell yourself that you "need" a new TV, or you "need" 3 bedroom house, etc. Ask yourself, "Will I die if I don't get this?" 99% of the time the answer is, of course not. It's not a need. It's a want.

People who build wealth don't buy what they need. They buy what they can afford. If you can't afford to buy a new car, then make the old one last longer. If you can't afford steak, then buy hamburger. Etc.

Don't think in terms of what you need. Think in terms of what you can afford.