First of all, I own a home, own rental homes, and a few years back, I was renting an apartment in Raleigh. So, if you want someone who can give you a good answer to whether you should buy or rent, you are hearing from them right now, although it can sometimes be a complicated question.

Of course, it CAN seem very simple depending on the situation. For example, as someone who lives in Myrtle Beach, I’ve probably heard some variation of this same story at least a dozen times:

“Yeah, we used to live in New York/New Jersey, and we sold our house for $900,000. Then, we moved down here and bought a much nicer house for $400,000 and had half a million dollars left over.”

Those are people who could legitimately say, “My home was a great investment.” However, is that true for most people? Not really.

For one thing, liquidating a home isn’t like selling stocks or Bitcoin. It’s a real pain in the behind AND you have to find somewhere else to live. It also doesn’t produce regular income. If you buy a home and live in it for 30 years, even if it’s worth a million dollars, you can’t buy a car or pay for your kid’s private school with the revenue from it because it doesn’t produce any. On the contrary, a house COSTS you revenue and sometimes, it’s substantial. Setting aside property taxes and insurance, you’re going to need a new roof, maybe even every decade depending on what type you get. Your heating/air conditioning system? That’s another big expense every 10 years and repairs just come with the territory.

Here in Myrtle Beach, in the summer, it gets very hot and very humid, which leads to a lot of houses having problems with moisture. Personally, I have had to replace roughly half the walls and floors in my house because of that. Then there are the more optional things in a house. For example, with me -- has the kitchen been redone? Yes. Bathrooms? Yes. Has the laminate been changed on the floor? Absolutely. What about the “COVID garden” I had built in the backyard? Trees had to come down, a fence went up, I added in an irrigation system, and I had a new building along with cement put in back there. Does it look nice? Absolutely? Was it cheap? No.

Additionally, I own my house and this plays into another important difference between renting and owning.

To rent a place? You are likely to only need two months’ rent right off the bat. Enough for a month’s deposit and your first month’s rent. With a house, estimates vary widely. You MIGHT be able to get by with as little as 1.5% - 3% of the cost of a home, but you will probably need to pay private mortgage insurance, which can really add up over time. If you can afford a 20% down payment, you can avoid the private mortgage insurance, but given that the average cost of a new home in the United States is currently $391,900 (and much, much, more in some places), we’re talking about having 78,200 to put down (AVERAGE). That’s a hefty sum, especially considering only 14% of Americans have $100,000 saved for retirement.

Now, let’s consider the cost of the interest on the money you’re going to pay to the bank. Right before the latest spike in interest rates, we had some of the lowest interest rates in the last 50 years and the cost of interest was still substantial:

To calculate the mortgage interest paid in a lifetime, we used the median sales price of a new home sold in the U.S. in the second quarter of 2021, which was $374,900. Keep in mind that the interest calculation would change for those homeowners who didn’t purchase their home this year.

The average APR for the benchmark 30-year fixed rate mortgage is at 2.78% at the time this article was written. Using Bankrate’s mortgage calculator, we found that someone purchasing a median-priced home with a typical 20% down payment would owe $142,614.31 in interest over the 30-year life of their mortgage. This doesn’t take into account any mortgage interest tax deductions that you may qualify for as a homeowner, which could lower your yearly tax burden.

Today? The “current average interest rate for a 30-year fixed mortgage is 7.39%” and it doesn’t look likely to go all the way back down below 3% anytime soon, if ever. In other words, if you get a house now, the $517,000 or so you could end up putting in to pay off the home and interest could be considerably inflated:

Certainly, no one knows for sure exactly how it’s going to play out, but all the signs seem to point toward America having long-term struggles with inflation, which is highly likely to lead to high-interest rates over the next few decades.

On the other hand, there are no guarantees your property value with continue to go up (and I really mean that… see Detroit).

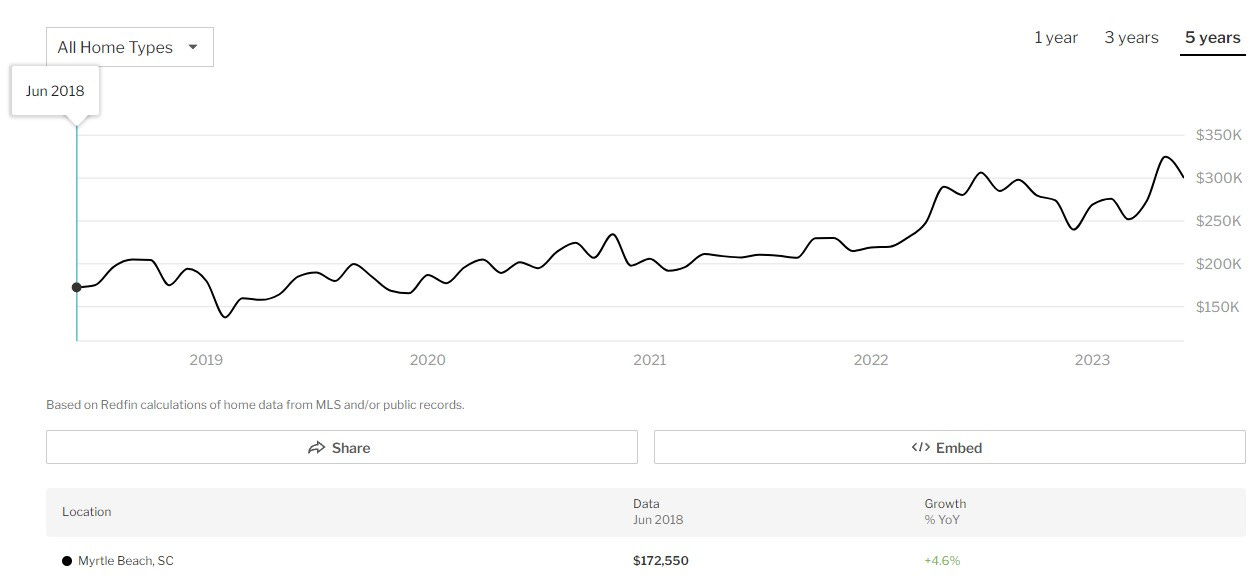

However, given the traditional 4.18% annual increase in homes over the long haul in America, it’s very possible that an almost $400,000 house will be worth more than a million dollars in 30 years if you take care of it (although inflation will make that number look considerably less impressive then than it does today). For example, I live in one of the fastest-growing counties in America right now and the surging cost of homes reflects it. Just look at the last five years:

On the other hand, you may look at all this and say, “There’s just too many question marks, so I just want to rent.”

If that is you, as we mentioned earlier, renting requires a lot less capital than buying and it’s flexible. You don’t like one apartment? Go find another. Are you tired of New York City? Great, pack your bags and move to Miami when your lease is up. That’s easy-peasy if you’re renting and an ordeal if you own a house.

On top of that, you’re not going to be on the hook for insurance, property taxes, upgrades, or major repairs – which is certainly good. However, if you are a renter, it’s a good idea to keep this rule of thumb for landlords in mind:

The amount will depend on your specific situation, but a good rule of thumb is to aim for at least 10% profit after all expenses and taxes. While 10% is a good target, you may be able to make more depending on the property and the rental market.

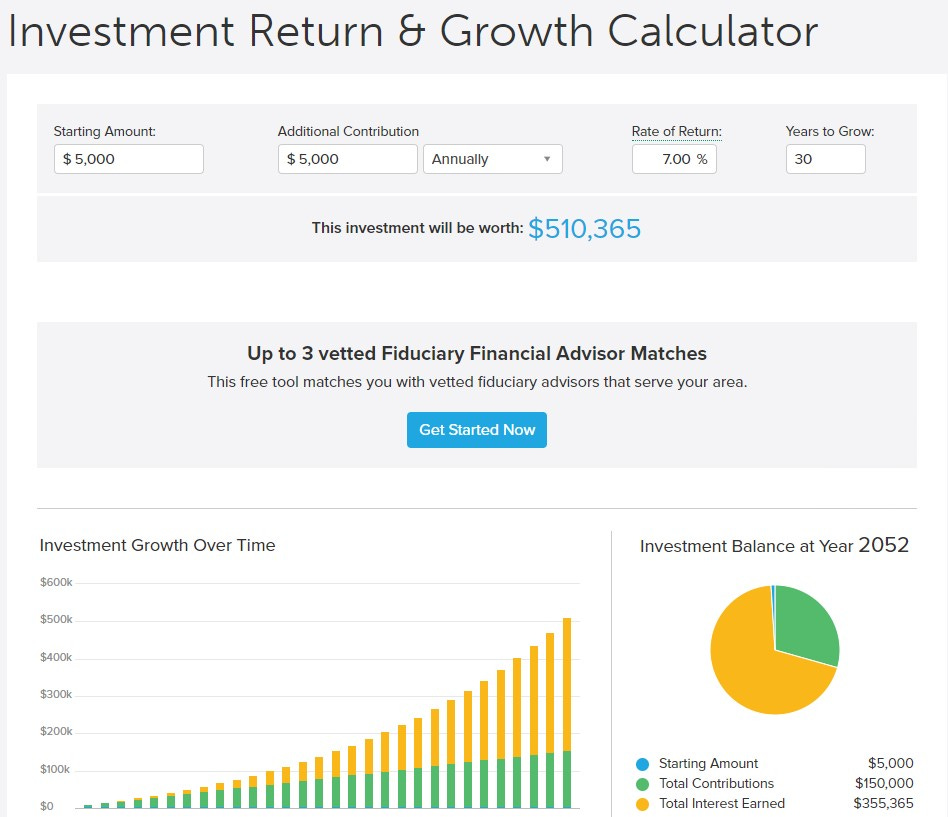

Granted, many (but certainly not all) landlords may be able to get a property cheaper than you could because they accumulated enough capital to buy a property outright or in the case of major investors, are wealthy enough to get really good terms on a loan. But if they’re trying to make enough to pay off their property in 10 years, that means if you stay somewhere for 10 years, you may at least be in the ballpark of having paid what the property cost the landlord. This is why rent in the United States often isn’t too far below what it would cost to buy a home outright. The median rent in the United States right now is $1,739. Theoretically, if you took the difference between what you paid in rent and the cost of buying a house and invested it, you could make up a significant chunk of the difference between owning a house and renting:

Still, how many people are actually doing that? Not necessarily all that many once you get beyond the Baby Boomers, who are much more likely to own a house and hold more assets than younger generations.

What it all comes down to is that renting is much more flexible, has a much lower barrier to entry than buying, and theoretically at least, might leave you with more money to invest. On the other hand, over the long haul, the vast majority of people are going to be financially better off buying a home than renting. That has been true for a long time and it still is today.