The Foolishness of California’s Wealth Tax

Ray Dalio is a brilliant investor and student of world history who has studied the rise and fall of civilizations. He thinks America is headed for some very rough waters in the next few years. In his theory, there are six stages of civilization. Number 6 is civil war, revolution, or massive societal upheaval, and right before that, in the lead-up, is stage 5. Here’s part of what he said you should expect to see in that stage:

…Those places (cities, states, and countries) that have the largest wealth gaps, the largest debts, and the worst declines in incomes are most likely to have the greatest conflicts. Interestingly, those states and cities in the US that have the highest per capita income and wealth levels tend to be the states and cities that are the most indebted and have the largest wealth gaps—e.g., cities like New York, San Francisco, and Chicago, and states like Connecticut, Illinois, Massachusetts, New York, and New Jersey.

Facing these conditions, expenditures have to be cut, or more money has to be raised in some way. Who will pay to fix them, the “haves” or the “have-nots?” Obviously, it can’t be the have-nots. But when the haves realize that they will be taxed to pay for debt service and to reduce the deficits, they typically leave, causing the hollowing-out process.

This is particularly relevant because we’re seeing the idea of wealth taxes being floated in California. Wealth taxes are pretty much always bad ideas, the sort of thing nations turn to when their backs are against the wall, and they’re headed down the tubes. However, the wealth tax being floated in California is particularly disastrous to founders of companies and makes it extraordinarily dangerous for them to stay there.

Granted, California is already a poorly run state with high expenses, even higher taxes, and insufferable politicians and activists, but it has advantages, too. Big cities, great ports, lots of tech talent, and beautiful countryside. I just got done vacationing for a week in San Francisco. Setting aside the amazing food and pleasant weather, when you look at these pictures I took in San Fran and the surrounding area, you can understand why ludicrously wealthy people might be willing to pay more to live there.

Still, there’s a difference between paying a premium to live somewhere, which pretty much anyone who pays taxes in California is already doing, and having greedy parasites take a significant part of the money you’ve earned IN YOUR ENTIRE LIFE just for the privilege of having their state as your primary residence.

The incredibly wealthy tech bros who live in California have been a huge asset to the state. They pay staggering amounts of taxes, create lots of other high-paying jobs, and have turned California into one of the biggest technology hubs on the planet.

So, what happens when they leave?

And guess what? They have already started leaving:

First of all, you have to understand that for people with these kinds of resources, it is not difficult at all to change their primary state of residence. Basically, you just sell your house, buy a new one somewhere else, get a dentist and a doctor there, and spend less than 6 months of your year in California, and congrats, another state is getting your tax revenue. For people like this, it’s easy-peasy-lemon-squeezy:

California’s loss is Florida’s gain. Florida is going to get more tax revenue and more jobs out of this, while Page is going to keep a lot more of his money. Heck, if Page wants, he can STILL spend 6 months of the year in California – and for someone that probably travels as much as he does, he might not even notice the difference in how long he’s in California other than he will be staying in 5-star hotels and rented mansions instead of his own place. Florida benefits and Page benefits, but California? Not so much. They’re living out that old Aesop’s fairytale about killing the Golden Goose in real time.

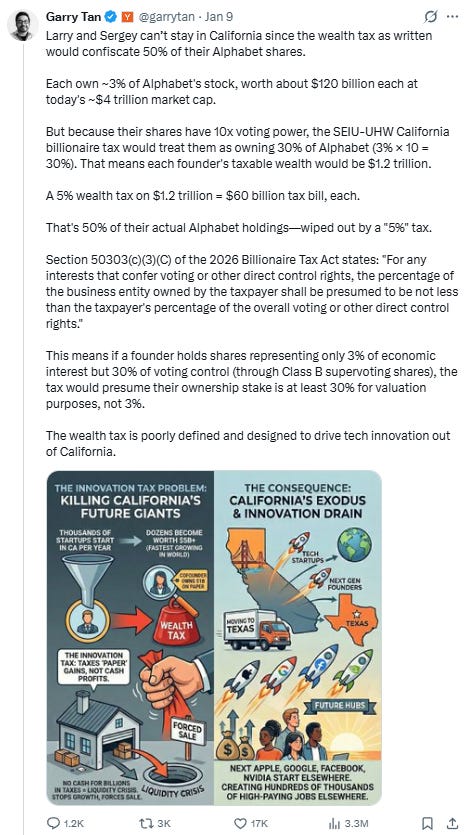

In fact, California’s wealth tax is so punitive and poorly designed that you have to wonder if it’s INTENTIONALLY DESIGNED to drive wealthy tech bros out of California. Let me show you what I mean:

Usually, people just assume that liberals are so economically ignorant that they do things like this accidentally. Certainly, that could be the case because wealth taxes and, worse yet, taxing unrealized gains (gains on paper that haven’t been realized by being sold yet) is such an ignorant idea that only a fool would suggest it, but there could also be another motive.

An awful lot of liberals hate billionaires and want to tax them into oblivion. Of course, conservatives delight in pointing out the obvious hypocrisy of liberals railing against billionaires while they simultaneously get so much funding from them. But that’s also a problem for Socialist Democrats. How do you convince people in your party to destroy billionaires when they’re relying on money from billionaires to function? You don’t. That’s why the bark of Democrats is always worse than the bite when it comes to the wealthy. Sticking with that dog analogy, you don’t bite the hand that feeds you.

However, if all the tech bros got pushed to the Right, who would be left inside the Democrats’ tent to say, “Whoa, raising taxes this high on the wealthiest people is a bad idea!” Not a lot of people.

So, is this idea the result of economic ignorance or malice? It’s hard to say, but even if the wealth tax in California doesn’t pass, it’s going to hit their economy like a bomb at this point. Their Golden Goose is bleeding out on the floor right now, and they have no one to blame but themselves.

If they still earn any income in California, they will still owe taxes to CA. CA also does its best to tax part time residents.

While I was attending graduate school in Oregon, my wife was working and residing in CA. I had to pay taxes to both Oregon and CA on the income I earned in Oregon. If we had divorced, that would have stopped the need to pay taxes to CA. But she was living in the house that we purchased, and I am also on the deed. For CA, that is all it took to be a CA resident.

It works the same for pro-sports players. They could live in Texas, but every game they play in CA, that part of their pay is taxed by CA. This is even if they do not actually play in the game but are present with their team.

Out of state students who attend school in CA, have 30 days to register their vehicle in CA and meet smog regulations. Most do not know that. They believe since they are out of state students and non-residents they can keep their out of state plates. There is a private college in the city I live in. Every year, about 30 days after the start of the school year, law enforcement goes through the parking lots and set up enforcement check points at places around the college. They pull over students driving out of state plated cars. They get hit with a huge fine and have 30 days to pass smog or take their vehicle out of state to never return it to the state until it passes smog.

CA is also getting ready to require all diesel vehicles, even privately owned ones, from out of state to pass CA diesel smog regulations. All of those RV people will likely decide to avoid CA.

The sad thing is, of stores you see these people with signs up that say help increase school funding and provide financial assistance to first time home buyers. People sign it, because it is for a good cause.

At school, our union is pushing that teachers sign it. I refused and said this will cause the wealthy to flee CA faster than they already are. Those that already pay the most taxes to the state will leave and take their tax revenue with them. I have been told that will not happen.

I am glad I am retiring at the end of May and then will be leaving the state for good. I doubt I will ever return, even for a visit.

I live 100 miles from San Francisco and very close to I-5. My neighborhood has been flooded with Bay Area refugees who buy houses here that are close to the freeways because they will commute 2 or 3 hours one way to their high paying Bay Area jobs. A few times a week we have a real estate agent contacting us to see if we will sell to a client interested in buying our house for well over the current market value. The market value has increased by 50% in one year at the same time Bay Area houses have lost market value. My house needs about $100,000 in repairs, but that does not stop the offers coming in. I told my wife that we should stop planning the repairs we intend to do this summer. We will not get much of a return by doing the repairs because we are in the perfect location for Bay Area commuters.

This is ludicrous. Par for the course in Commyfornia. People need to fight instead of run. I understand it. But I would be very thankful if these tech bros were to stand and fight them politically. Their tech savvy and sway within social media would give them a great advantage. Other states will enjoy the tax revenue they will bring, but I'm willing to bet, due to witnessing it here in Washington, that they will also inflate real estate….