Why Rent Control Always Leads to Higher Rent

Why Joe Biden’s new rent control proposal would be a disaster for America.

Contrary to what some people may think, economics is not really simple. There are different schools of thought, arguments about different concepts, and even protracted battles about what to measure to best understand changes. That being said, there are parts of economics that just about everyone can easily understand like supply and demand.

If tens of millions of people want a Lamborghini, but there are only a small number to go around, that means the demand is high, the supply is low and thus the cost of the car is going to be high.

On the other hand, there’s almost no market at all for a jar of ordinary dirt and because it’s so easy to acquire, the supply is going to be nearly limitless. So, if the demand is that low and the supply is that high, the cost is essentially going to be nothing.

So, think about something like apartments or rental houses. If it’s a seller’s market and there are very few places available with lots of people that want to rent, prices will be high. On the other hand, if it’s a buyer’s market and there are few people that want to rent a glut of places available, prices will be cheap. In other words, if you want to reduce the cost to renters, the key is contained within the laws of supply of demand.

Although we haven’t gotten all the details, Joe Biden is about to take steps to dramatically reduce the supply of available housing. Here’s the current info on Biden’s proposal from the Washington Post:

President Biden will unveil a new proposal in Nevada on Tuesday to cap rental costs nationwide, according to three people familiar with the matter...

...Biden’s plan — which would need to be approved by Congress — calls for stripping a tax benefit from landlords who increase their tenants’ rent more than 5 percent per year, the people said. The measure would only apply to landlords who own more than 50 units, which represents roughly half of all rental properties, the people said. It wouldn’t cover units that have not yet been built, in an attempt to ensure that the policy does not discourage construction of new rental housing. The people spoke on the condition of anonymity to describe a proposal that isn’t yet public.

...The president hinted at the plan during his news conference at the conclusion of the NATO summit last Thursday, surprising aides who didn’t expect to reveal the announcement yet. Biden also referenced a plan to “cap rents” during his late June debate with Trump, although he has not explained the policy publicly or how it would work.

...“It’s time to get things back in order a little bit. For example, if I’m reelected, we’re going to make sure that rents are capped at 5 percent increase — corporate rents, for apartments and the like, and homes, are limited to 5 percent,” Biden said at the news conference.

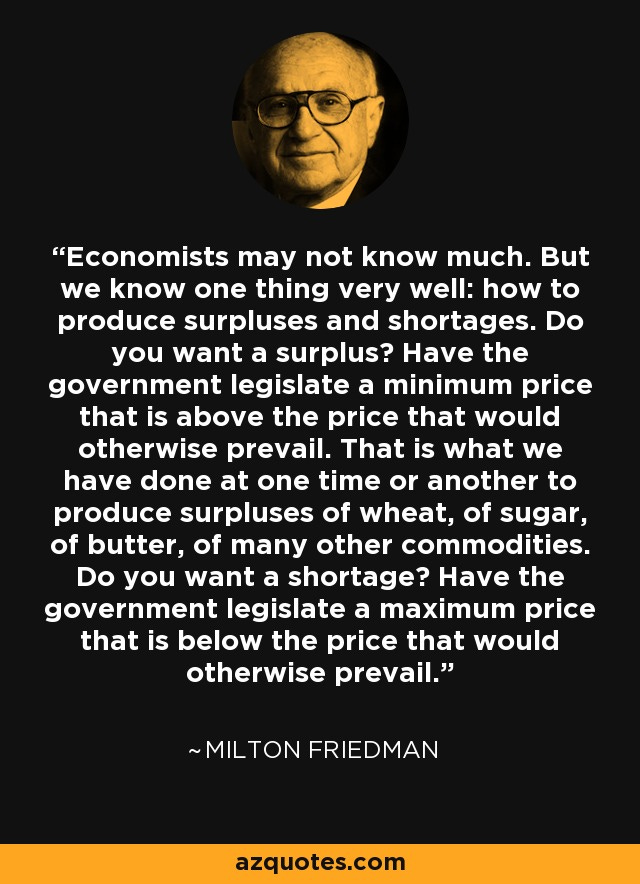

So, although we don’t know the full scope of it yet, what Biden is proposing here is rent control. Know what rent control does? It creates the sort of supply shortages the late, great Milton Friedman was referring to in this quote:

Why would limiting rent increases to 5% create a supply shortage?

Well, you have to think about it from the perspective of an investor. There are a lot of things you can put your money into: stocks, bonds, crypto, rentals, paintings, jewelry, loans, business franchises – it goes on and on. The name of the game is first and foremost, not losing your money, but beyond that, you want to make as much money as possible.

Rental housing already has a lot of disadvantages compared to some other forms of investment. It’s hard to liquidate your investment. You have insurance and taxes to pay on it every year. As all homeowners know, you can also have considerable surprise expenses that can crop up at any time. Your roof may leak. You may need a new HVAC. Right now, I’m having to replace a wall in my bedroom. It’s not cheap. You also have to deal with people, sometimes including very difficult people. Squatters. People who are looking to sue you. People looking to tie you up in court and get a few months of free rent. When someone is deciding where to invest their money, all of those things need to be weighed into it.

So, if the Biden administration limits rent increases to 5%, the first thing the people impacted by it are going to do is some math to determine if they’re making or losing money. In 2023, they would have been losing money hand over fist because their expenses went up considerably more than 5%. Just to name three factors, consider homeowners insurance, property taxes and repairs:

The nationwide calculated weighted average premium rate increase for owner-occupied homeowners insurance was 11.3% through Dec. 29, 2023, according to S&P Global Market Intelligence's RateWatch application. In total, 25 states saw an effective rate change of at least 10% in 2023, compared to only six states during the prior year. The three states with the highest effective rate changes in 2023 were Texas (23.3%), Arizona (21.8%) and Utah (20.3%).

Property taxes went up a good bit, too:

According to real estate data firm ATTOM, the average property tax bill increased 4.1% last year. And some areas of the United States experienced higher tax hikes than others....Average property taxes in Indianapolis, Indiana increased 18.1%, which is significantly less than in Charlotte....Kansas City, Missouri homeowners paid an average of 16.8% more last year than the year before.

Then there’s home repairs:

According to Realtor.com, average home maintenance costs had reached an all-time high after increasing 8.5% year over year, from $5,984 in 2022 to $6,493 in 2023.

In other words, in most cases, the costs to landlords went up CONSIDERABLY more than 5% last year. So, what the Biden administration effectively intends to say to landlords is, “We want you to be a charity. We want you to eat these costs and lose money so your tenants can have cheaper rents.”

That’s going to cause two things to happen.

The first is that the people who currently own homes are going to look for ways to get out from under Biden’s 5% limit. There’s no way to know precisely what that will entail before legislation has been passed, but whatever changes they do make are HIGHLY LIKELY to lead to fewer available rental units. Maybe they’ll rent them all out as Airbnb. Maybe they’ll turn the whole building into office space. Maybe they’ll set up timeshare condos? Who knows? But what we do know is that most landlords are not going to just happily lose money so Joe Biden will have something to brag about on the campaign trail. They’ll do anything and everything they can to try to protect their investments.

The second thing that’s going to happen is a major league slowdown in building new homes. Sure, the Biden administration can say, “This only applies to the existing inventory, not new apartments,” but people aren’t stupid. If nationwide rent control becomes a reality, it’s only a matter of time until new buildings are impacted by it as well. That would create an enormous amount of uncertainty around building new housing and given the high cost and difficulty of liquidating homes and apartments, it’s highly likely that the amount of money being invested into new buildings would crater. Why take the risk of putting a huge amount of capital into building a new apartment complex when the government may change the rules to practically guarantee that you’ll lose money at any point?

So, what would that mean? It means that if Biden gets his way, the number of rentals available will dip tremendously over the next decade or two, leading to massive shortages and much higher costs for those who are able to rent a place.

If you want to lower rents, you don’t reduce the supply of leasable spaces with rent control, you find ways to incentivize more rentals to come on the market. It’s far from rocket science. It’s just the law of supply and demand in action and it’s about as economically simple as it gets.