The Debt Fueled Economic Apocalypse People Have Been Predicting for Decades May Be Just Starting

Is it finally here?

People have been talking about the potential consequences of our nation’s irresponsible accumulation of debt for almost as long as I’ve been alive. Every person reading this has heard some variation of, “If we keep borrowing all this money, people will lose faith in the dollar, quit buying our bonds, and it’ll cause us to go bankrupt!” Then, someone usually chimes in with, “HA! America can’t go bankrupt because we can always print our own money!” Next, the response to that is something like, “Yes, we can print our own money, but it’ll lead to hyperinflation like Weimar, Germany and you’ll need a wheelbarrow full of cash to buy a loaf of bread! You can say that isn’t bankruptcy, but it sounds like it to me!” On and on it goes… and it makes perfect sense, right? We all understand on a very fundamental level that we can’t keep borrowing ever-increasing amounts of money or at some point, we won’t be able to pay it back and everything will fall apart.

The problem is that human beings as a general rule and politicians, in particular, tend to be highly focused on getting pleasure and avoiding pain in the short term while ignoring that there will potentially be severe consequences for our actions later. This is how people get in debt, get hooked on drugs, drink and drive, and do a thousand other dumb things that we human beings do. It really is human nature for people to put all of that out of their minds until something horrible happens and we get shocked back into reality. Someone quits smoking right after they get a lung cancer diagnosis or drops 50 pounds to get a “revenge body” after their husband leaves them. Didn’t they know there was a problem before? Of course, they did, but until they actually burned their hand on the hot stove, it didn’t truly sink in. Americans have never had that kind of experience when it comes to government spending.

Sure, on an intellectual level they may understand that every taxpayer owes almost a quarter of a million dollars in debt, but isn’t the government still able to print and borrow as much money as it needs? Aren’t there politicians suggesting insanely expensive new programs all the time? Sure, the politicians in DC are jackasses, but someone there knows what they’re doing, right? They wouldn’t let us get in way over our heads, would they?

What people forget is that politicians, especially the sort of soulless narcissists and sociopaths who tend to succeed in DC, operate just like every other human being. They tell people whatever they want to hear to get reelected today and figure that by the time things get really bad, it’ll be someone else’s problem. Granted, they may hope that the big economic nightmare scenarios are way down the line, but they’re just as much in the dark as the rest of us about when the bill is ultimately going to come due for America’s financial idiocy.

Disturbingly, according to one famous economist/investor, Peter Schiff, the waitress is walking over to the table with the check as we speak:

"We have a lot more debt now, and the economy is less able to tolerate 5% interest rates than in 2008 and 2018. Think about it. If the Fed Funds Rate got to 5%, I’ll bet the 30-year mortgage rate would be 9%. People can’t afford to pay 9%, especially when they are borrowing 95% of the value of the home. So, it’s a massive mortgage. ... This housing market was built for 3.5% mortgages, not 9% mortgages. Look at the federal government. We have a $31 trillion national debt. If the Fed got up to 5%... how is the government going to have to spend $1.5 trillion a year on interest payments on the national debt?... It’s impossible. What about all the debt corporations took on? It has to be rolled over. How are they going to go from 2% or 3% to 7% or 9%? What about all the junk bonds? How are they going to survive? What about all the municipalities and state governments that have borrowed money at low rates? How are they going to roll that debt over? What about commercial real estate? How are they going to survive? ... The Fed created an economy completely dependent on near 0% interest rates and inflation. ... There is going to be no way to finance these companies. So, there is going to be a massive implosion. If the federal government is going to stop monetizing debt and raise interest rates, we need massive cuts to government spending.” ... “The dollar is going up because people think the Fed can succeed at bringing inflation down to 2%. Every time we get inflation that is above consensus, the market thinks the Fed is going to have to fight harder to win. So, they bid up the dollar because the Fed is going to have to raise rates more. They don’t realize inflation getting worse is a sign that the Fed is losing, and eventually it will surrender. Inflation will win, and inflation is here to stay.” ... "The Fed is damned if it does and damned it is doesn’t... The day of reckoning is finally here. We have this massive inflation problem, and there is nothing that governments and the central banks can do to solve it because up until now, inflation has been their solution for every problem. Now that inflation has become the problem, they have no solution.”

Put another way, what Schiff is arguing is that we’ve maneuvered ourselves into an inescapable trap.

Let me explain.

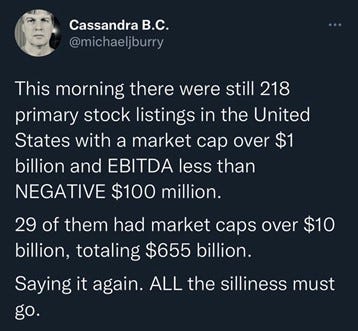

We’ve built an economy that can only thrive with almost unlimited amounts of “cheap” money printed by the Fed funding it. That’s how this can be possible:

What he’s saying there is that there has been so much cheap government money floating around at a low-interest rate that lots of companies with negative revenue streams have been bid up into the billions based on what they could potentially do in the future. Under normal circumstances, this would not be possible and there’s an excellent chance that many of these companies are going to go out of business unless the Fed gets back to pumping up the economy.

So, why doesn’t the Federal Reserve start cutting interest rates?

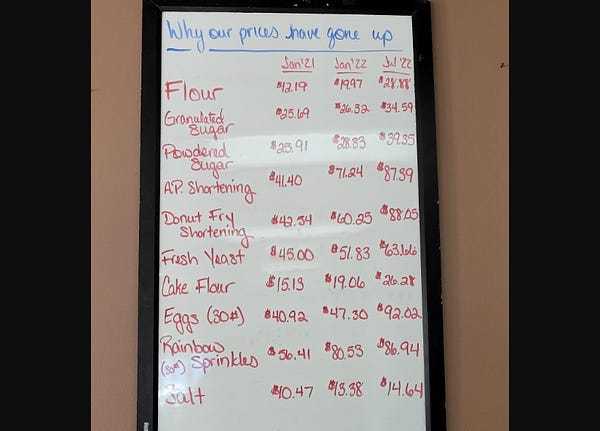

Because for the first time since the early eighties, inflation is running extremely hot, and this is a very bad thing. As a practical matter, inflation is a crushing, regressive tax that particularly hurts the poor and middle class. Ordinary people cannot take numbers like these year after year:

So, how do you get inflation under control?

The Federal Reserve raises interest rates, which slows the economy. You might say, “But John, wait. Are you saying that the Federal Reserve is DELIBERATELY trying to hurt the economy?” That is correct. In essence, the Fed’s job is to balance inflation and the growth of the economy. They want the economy to run nice and strong with inflation at around 2%. The problem is that during COVID, they printed far too much money to keep the economy humming along despite the fact that there was a global pandemic and worse yet, American politicians literally forced people not to work. This, along with insane levels of government spending led to out-of-control inflation which the Fed was far, far too slow to address.

The rub is that typically what the Fed does is raise interest rates HIGHER than inflation to get it under control. Ideally, that would be about 9%.

The problem is that as Schiff notes, that doesn’t seem to be possible:

We have a $31 trillion national debt. If the Fed got up to 5%... how is the government going to have to spend $1.5 trillion a year on interest payments on the national debt?... It’s impossible. What about all the debt corporations took on? It has to be rolled over. How are they going to go from 2% or 3% to 7% or 9%? What about all the junk bonds? How are they going to survive? What about all the municipalities and state governments that have borrowed money at low rates? How are they going to roll that debt over? What about commercial real estate? How are they going to survive? ... The Fed created an economy completely dependent on near 0% interest rates and inflation. ... There is going to be no way to finance these companies. So, there is going to be a massive implosion. If the federal government is going to stop monetizing debt and raise interest rates, we need massive cuts to government spending.”

This is the inescapable trap we were referencing earlier.

If the Federal Reserve raises interest rates to where it ideally needs to be to stop inflation, the economy will collapse, state governments will default, and the interest payments on the debt will so rapidly escalate the size of our national debt that other nations will lose faith in our Treasury Bonds. We could offset some of these problems with big spending cuts. However, realistically, to make cuts big enough to mean anything, they’d likely end up having to come out of Social Security, Medicare, and/or Defense. All of those options would be so wildly unpopular that it’s hard to imagine any serious attempt being made to get spending under control.

On the other hand, the Federal Reserve could pivot early and go back to pumping the economy to avoid those outcomes, but that would leave inflation still burning out of control. This would economically decimate poor and middle-class Americans which would lead to dramatically increasing discontent and poverty. You think things are on the “wrong track” now? Then imagine what they’d be like after 5 to 10 years of all the regular folks in America feeling like they were getting significantly poorer every year with no hope of it getting better.

Does this mean we’re doomed? Schiff is essentially saying, “yes.”

However, there is a potential temporary fix that the Fed is maneuvering us toward that could possibly work for a while. That would be slowing the economy with interest rate hikes until it goes into a steep recession. Then the sharply reduced economic demand could be enough to get inflation back under control, which would allow the Fed to start pumping the economy up again. This is what most people in the know assume is going to happen… and it may. The problem is that our massive government spending has made us so weak that there is also a genuine possibility that it WON’T WORK THIS TIME and Schiff could be right.

In other words, this could be as economically good as it gets in our lifetimes. Let’s hope that’s not the case. Let’s pray that’s not the case, but it’s a real possibility and we need to acknowledge that. Unless we get real about where we are as economically as a nation and how bad this could get, the scenario Schiff outlined is fated to become reality.

I've noticed for a long time now that Democrats, especially, have simply abandoned the need to explain logically how they plan to solve whatever problem they highlight. They just promise that they will "invest" an enormous amount of money, i.e. make giant government transfer payments to their intended voter support bloc, and wave their hands and say things like; "we do things to help. Republicans only care about rich, white people." With the State Media refusing to challenge the absurdity of this practice, it has been implemented, repeatedly, on a massive scale, and you really can't put the toothpaste back in the tube. I see no logical way this problem is solved, because the Democrats have also destroyed the education system so badly that we no longer produce enough citizens who can even understand the problem of "just let the Federal government pay for everything." To paraphrase Thomas Sowell "if you think printing money is the same as creating wealth, you're totally misinformed and you're going to create more, and far worse, problems than you're trying to solve." The toboggan ride is fully underway, so grab your caps and brace for impact...

I have absolutely no confidence or faith in the government to make the necessary decisions to control inflation, whether Republican or Democrat. They are the foxes guarding the henhouse, and because they are not poor or middle-class inflation doesn't affect them at all. Those that their fiduciary malfeasance does affect they don't care about or probably hate, and our suffering sends them to bed at night dreaming sweet dreams of our misery. The Federal Reserve needs to go, and so do 90% of the politicians now in office.